Assessor's Office

|

Assessor |

Office Hours |

|

|

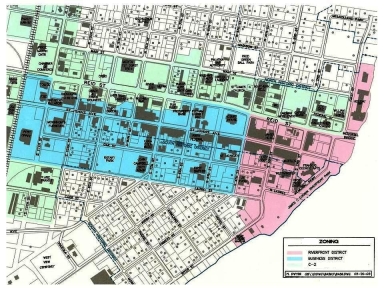

Download the Rumson Borough Tax Maps here. |

||

Assessments and Reassessment Process

- Rumson 2021 Reassessment Report

- Frequently Asked Questions (Updated 7/22/2021)

- Rumson Appeal FAQ

- 2020 Reassessment Q&A Presentation (December 9, 2019)

- Assessment Records Search

- Appeal Instruction Handbook

- Appeal Website (Available 12-1-19 to 1-15-20)

Learn more about the 2020 Borough Tax Assessments Here

Deductions, Exemptions, and Abatements

New Jersey offers several property tax deductions, exemptions and abatements. These programs are managed by your local municipality. Tax deduction, exemption, and deferment programs include:

- $250 Property Tax Deduction for Senior Citizens and Disabled Persons;

- $250 Property Tax Deduction for Veterans;

- 100% Disabled Veteran’s Property Tax Exemption; and

- Active Military Service Property Tax Deferment.

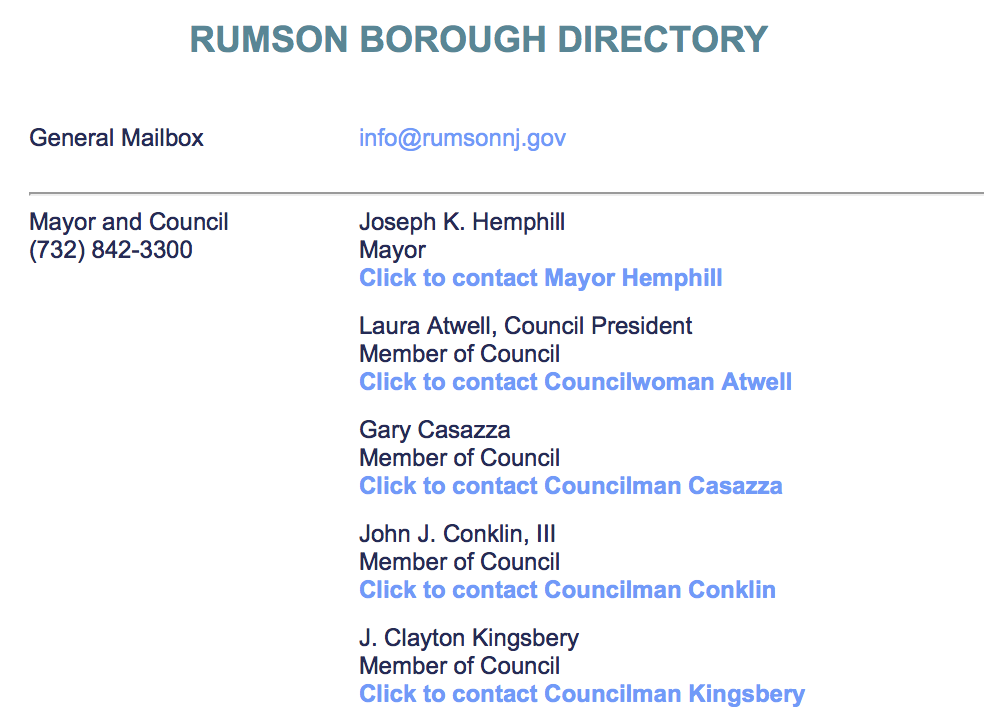

By way of introduction, I am Erick Aguiar, the new Assessor for the Borough of Rumson. As the new Assessor, I am becoming familiar with the community and have received a warm welcome from those I have had correspondence. I welcome residents to email me questions; and I will do my best to serve the property owners of Rumson. Thank you in advance for your cooperation and I look forward to working with you in the years to come.

The Assessor is governed by New Jersey State Law and regulated by the Monmouth County Board of Taxation in the establishment of property assessments. Assessors determine the full and fair value of each parcel of property at such price as, in their judgment, it would sell for at a fair and bona fide sale by private contract on October 1st of the prior tax year. (excerpt NJSA 54:4-23). New Jersey State Law dictates that assessments be maintained at market value.

The Ratio of Assessed Value to Market Value is 100% for the 2020 tax year. The 2020 tax rate is 1.433%.

Annual Assessment Program:

This year, the Borough has contracted with Realty Data Systems ("RDS") to perform an exterior and interior inspection of all properties

for the assessment records. This is the 2nd multi-year cycle required by the NJ Division of Taxation.

Many properties are scheduled to be inspected over the coming weeks, and there will not be further notice prior to your inspection. If you are not home during their visit, the exterior inspection will continue and instructions will be left for re-scheduling an interior inspection. If the company does not gain access to your property. my office may be forced to estimate all interior information. Please be advised this may result in an error on your property record card.

The inspection routes are predetermined, but RDS will do their best to accommodate residents. The RDS personnel carry identification and wear hi-vis vests/jackets. Our office and Police Dept. possess all inspector background information, NJDL#s and automobile characteristics.

If you would like to refuse the inspection, please visit www.rdsnj.com; click APPOINTMENTS to select the refusal form.

If you have any questions, please contact the Assessor's office.

Additional tax information is available from the Monmouth County Board of Taxation.

Deeds and tax records are available for public viewing at the official Monmouth County website.

State of New Jersey Division of Taxation: "http://www.state.nj.us/treasury/taxation/"

Tax Court of New Jersey: "https://www.njcourts.gov/courts/tax.html"

You may also contact:

Monmouth County Board of Taxation:

County Board of Taxation

Hall of Records

1 East Main Street

Freehold, New Jersey 07728

(732) 431-7404

Rumson NJ 07760

Rumson NJ 07760