Finance & Tax Office

|

CFO & Tax Collector

Deputy Tax Collector

Finance Assistant |

Office Hours |

|

|

|

||

The Tax Collector’s office is responsible for billing and collecting taxes, sewer and drive-in sanitation payments. These charges are considered municipal liens on each property.

The 2021 Tax Rate is $1.423 per $100 of assessed value.

PAYMENTS

- It is strongly encouraged to place your payment(s) in the drop box located in the main entrance of Borough Hall. Payments placed in the drop box after close of business will be posted on the next business day. The drop box is available 24 hours a day, 7 days a week.

- Payments can be mailed to:

Borough of Rumson, Tax Collection

80 East River Road

Rumson, NJ 07760 - Payments made through the mail will be posted to your account on the date received by the Finance & Tax Department, not the post-mark date (see below for more information)

- Payments can be made automatically by directly withdrawing funds from your bank. Click here for the Direct Debit Authorization Form

2021 Rumson Tax Calculator - See How Your Tax Dollars Are Utilized

TAX BILLS, DUE DATES and INTEREST ON DELINQUENCIES

Tax bills are normally mailed once a year. The bill has four payment stubs, with the first payment being due on August 1st. Taxpayers are urged to read all information printed on the front and back of the tax bill. Failure to receive a tax bill does not exempt a property owner from paying the taxes and/or municipal liens when due.

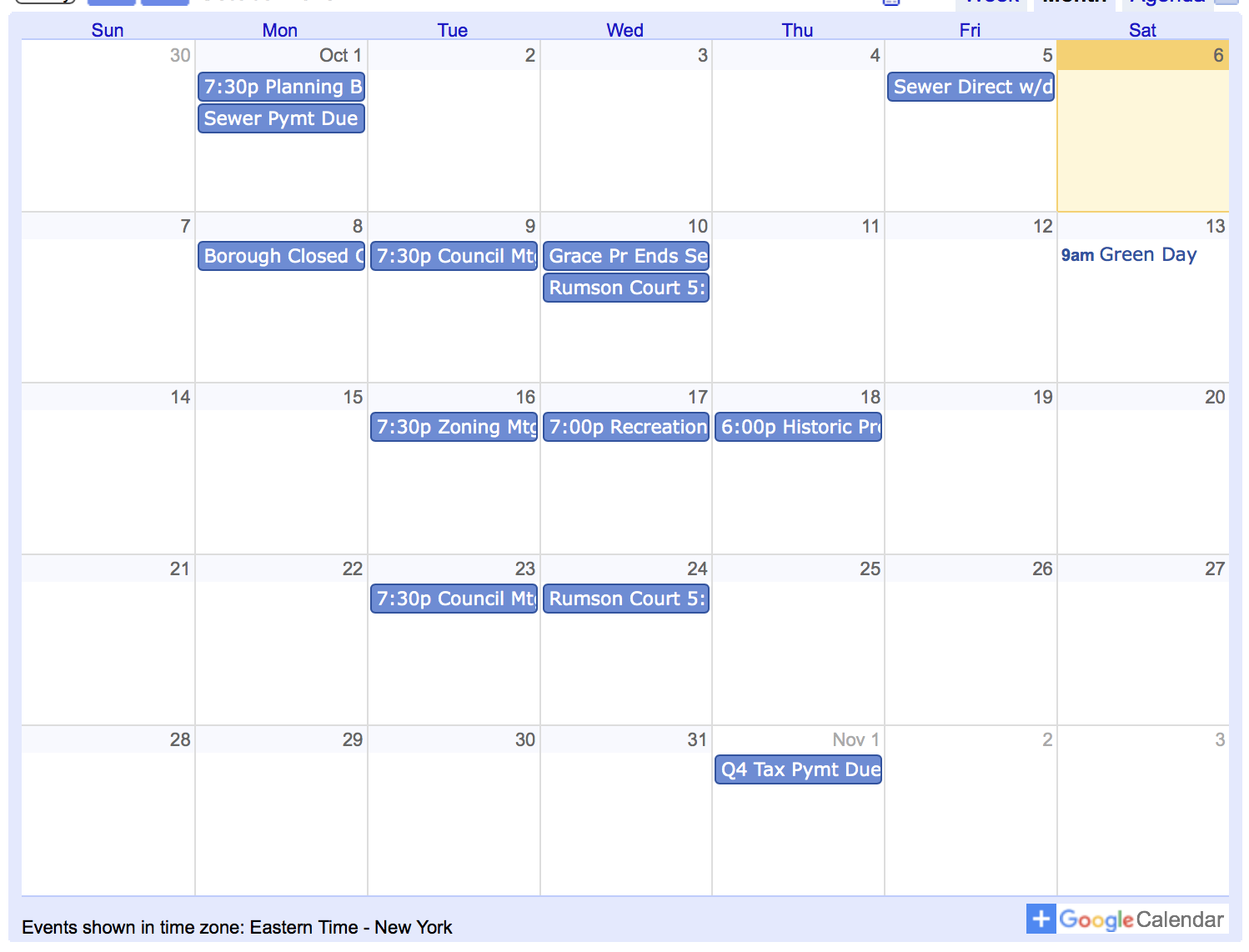

Quarterly Tax Payments are due February 1, May 1, August 1, and November 1. The Mayor & Borough Council have resolved to waive interest on the payment of any installment of taxes if the payment is received within the “Grace Period,” which is the first 10 calendar days of each respective tax quarter. Additionally, if the 10th falls on a Saturday, Sunday or Borough Holiday, this deadline would be extended to the next business day. If there is a delay in mailing the final tax bills, the next quarterly installment may have an extended Grace Period. Any extension in the Grace Period will be noted on the tax bill. In order to be considered “on-time” and avoid interest being charged to your account, payments must be received by the Finance Department within the “Grace Period.” If payment is not received within the Grace Period, interest is then calculated from the date when the payment was originally due (e.g., the first of the month) until the date of actual receipt of the payment. NOTE: Mailed payments will be posted as of the date the payment is received by the Finance & Tax Department, not the envelope's postmark date. Physical custody of your payment in this office determines receipt for our purposes. Tax & Municipal Sewer Due Dates and Grace Period end dates are noted on the Calendar of this Borough Website.

Please keep in mind that we are unable to accept postdated checks. We must be able to post the payment to your account and deposit it on the day it is received. Any postdated checks will be returned to you, which could cause a delinquency and interest accruing on your account. If you bank online, check with your financial institution before scheduling a payment. Some financial institutions use a processing company that mails postdated checks. These online banking postdated checks will also be returned to the processing company.

Interest will be calculated at 8% per annum on the first $1,500 and 18% per annum for any amount over $1,500 retroactive to the first of the month. A penalty of 6% will be charged on any delinquency (principal and interest due) in excess of $10,000 if not paid by the end of the fiscal year.

ADDED ASSESSMENT BILLS

If improvements are made to your home, you may receive an “added assessment” bill in October. This bill must be paid IN ADDITION to your regular tax bill. If your mortgage company is paying your taxes and your mortgage company has notified us to code your property with their bank code, a copy of the added assessment bill will be mailed to them. However, since each mortgage company handles these bills differently, we recommend contacting your mortgage company to confirm they will be making payment in order to avoid paying interest on these taxes.

TAX BILL CALCULATION

Your tax bill is calculated based on the assessment of your property (which is set by the Tax Assessor on October 1st of the previous year) multiplied by the current year’s tax rate then divided by 100. The yearly bill is a combination of the Rumson Municipal, Monmouth County, Rumson Board of Education and Rumson Fair Haven Regional High School tax rates. These rates are established based upon each entity’s annual budget. The February and May tax payment amounts due are estimated and equate to one-half of the previous year’s total tax bill. The August and November payments due are based on the total taxes due for the year, less the 2 payments previously billed (February & May) to arrive at a balance due for the year; that balance is then divided into two quarterly payments (August & November)..

RECEIPTS

Payments requiring receipts must be accompanied by the entire tax bill and a self-addressed stamped envelope. Otherwise, detach the appropriate stub and mail with your payment to the Office of the Tax Collector. Your cancelled check will be your receipt.

REBATES and DEDUCTIONS

The State of New Jersey has instituted several programs for property tax relief:

- Property Tax Rebate Program (“tax freeze”) 1-800-882-6597

- Homestead Rebate, 1-877-658-2972

- $250 Senior Citizen/Disabled Persons Deduction – contact the Tax Office

- $250 Veteran Deduction – contact the Tax Office

More information on these programs can be found on the Division of Taxation’s Property Tax Relief Program webpage at https://www.state.nj.us/treasury/taxation/relief.shtml.

NEW HOMEOWNERS

Tax bills are only mailed once a year and are not always transferred at closing. It is the new homeowner’s responsibility to obtain tax information. A copy of your tax bill is always available at our office per your request.

TAX SALE

Any municipal lien remaining unpaid on the eleventh day of the eleventh month of the current fiscal year is subject to Tax Sale at anytime thereafter per N.J.S.A 54:5-19.

Rumson NJ 07760

Rumson NJ 07760